Wilson.ai: GenAI Makes Its Way into Manufacturing

The industry has always faced new challenges brought by technological evolution, and today, following the ongoing wave of digitization, it is the era of artificial intelligence and GenAI.

The recent Transition 5.0 Plan, approved on February 26, 2024, revolutionizes the landscape of corporate investments, favoring companies that focus on high-energy efficiency machinery. This initiative offers significant tax incentives for businesses embracing this transition. Therefore, it becomes essential for machine manufacturers to adopt intelligent solutions, capable not only of monitoring energy consumption and certifying energy savings, but also of providing advanced suggestions for a responsible use of energy resources.

Together with Ransomtax – Your Business Partner, experts in consulting on the facilitative laws for industrial investments, we explored in detail the implications of Transition 5.0 and how the use of 40Factory MAT technology can facilitate the transformation to 5.0 compliant machines with minimum effort.

The approval of the Transition Plan 5.0, provided for in art. 38 of DL 19/2024, establishes an important goal and a commitment by the Government to accelerate the process of digitization of the Italian production system.

The legislator aims to encourage investment in digitisation and the transition to a green business economy through an innovative tax credit scheme. The Transition Plan 5.0 provides, in fact, 6.3 billion euros in addition to the 6.4 billion already allocated by the budget law, thus reaching a total of about 13 billion in the period 2024-2025 in favor of the digital transition and green Italian companies.

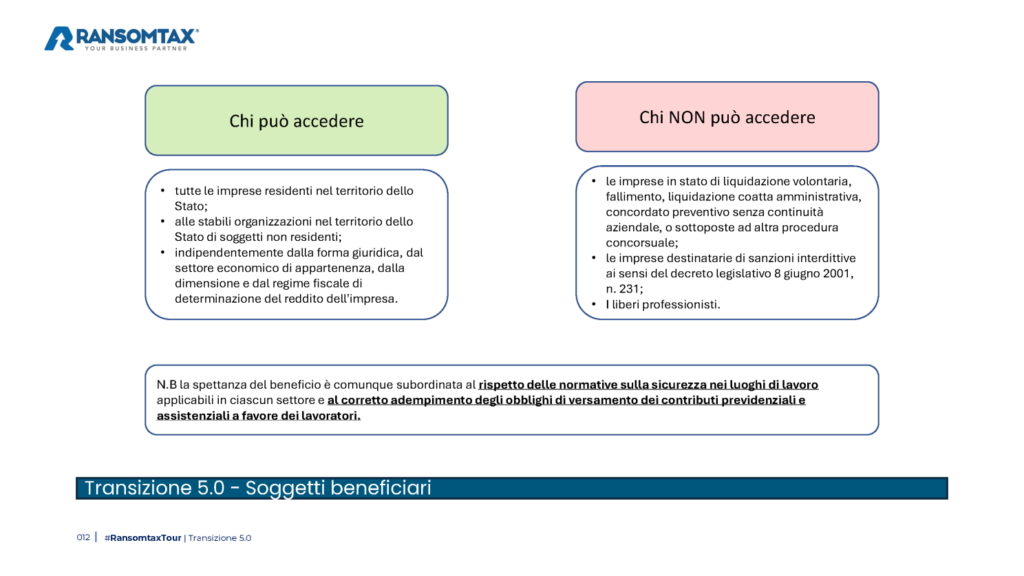

The beneficiaries relate to all enterprises resident in the territory of the State regardless of their legal form, economic sector, size and tax system of determination of income, that in the years 2024-2025 will make new investments in production facilities as part of innovation projects resulting in a reduction in energy consumption.

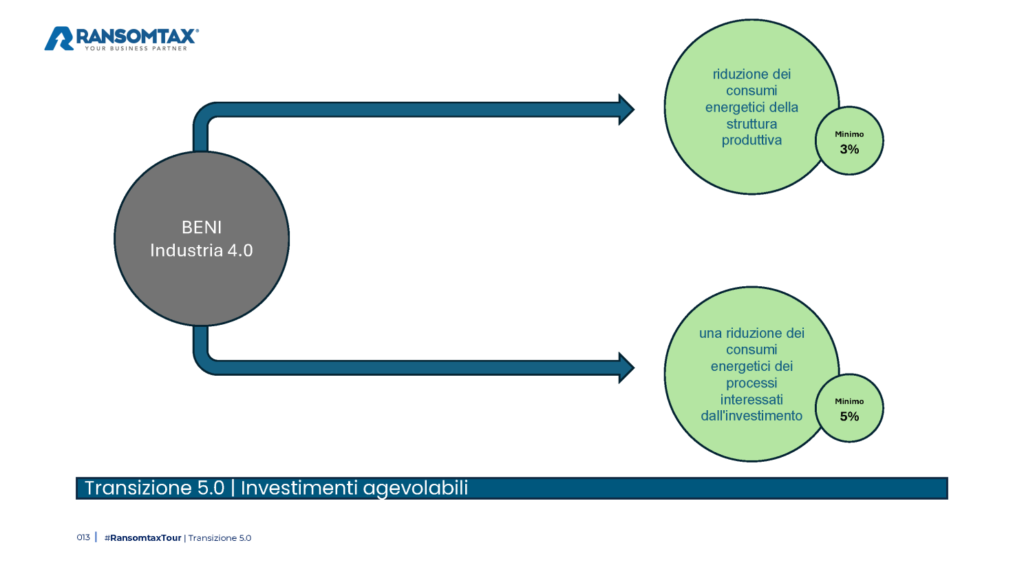

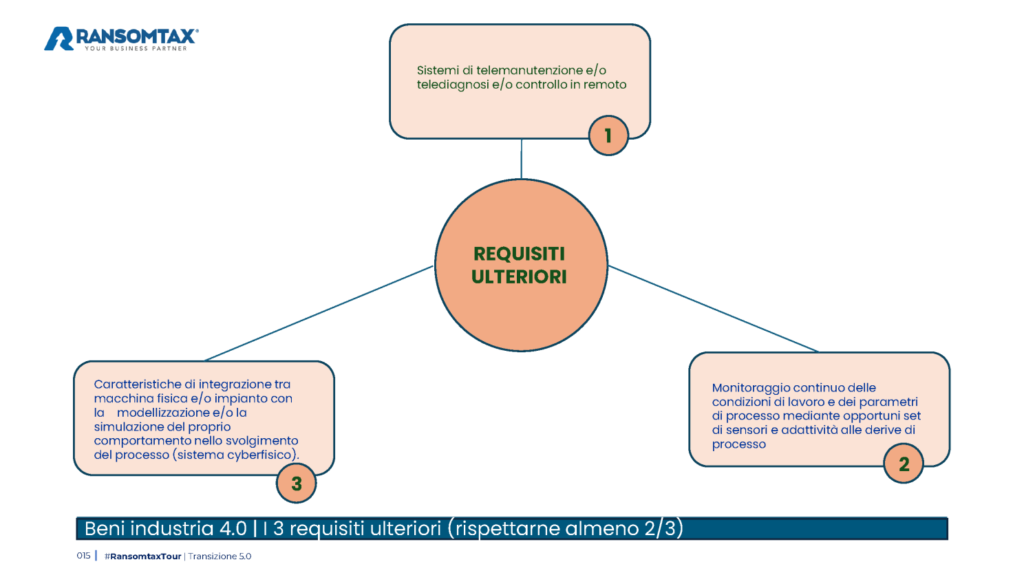

In order to obtain such a tax credit, the beneficiaries will have to include in their company a tangible or intangible asset that meets the requirements of Industry 4.0. Such goods must be able to guarantee at least a reduction in energy consumption of:

The objectives set by the new Plan, which entered into force on 2 March 2024, aim to consolidate and strengthen the efforts made by Transition 4.0.

While Plan 4.0 highlighted the crucial importance of implementing advanced technologies to stimulate a significant innovation leap in companies, Model 5.0 aims to overcome the mere technological dimension, also considering the positive ecological and social impacts of digital and green transitions.

Unlike the provisions of the Industry 4.0 Plan, the new Plan provides for the extension of the assets attached to Law B 232/2016:

Consequently, reference is made to all solutions that allow the monitoring of energy consumption, the autonomous production of energy or the optimization of energy efficiency and, if purchased jointly, also the related management software.

If Italian companies are committed to a path towards sustainability, it is therefore essential that they have tools and solutions to continuously monitor energy resources. However, the current spread of software based on artificial intelligence 4.0 risks losing effectiveness if they are not able to provide concrete support to the end customer to achieve real energy savings.

Faced with the new directives of Transition Plan 5.0, it becomes even more crucial to provide companies with solutions capable of effectively integrating the monitoring of utilities with practical strategies to improve energy efficiency.

In this perspective, the role of MAT, the industrial iot solution of 40Factory, is fundamental in supporting companies in the monitoring and optimization of energy consumption, thus facilitating the path towards environmental sustainability. MAT fully meets the Transition 5.0 requirements, allowing machine manufacturers to offer a comprehensive tool for analysing the energy efficiency of their products.

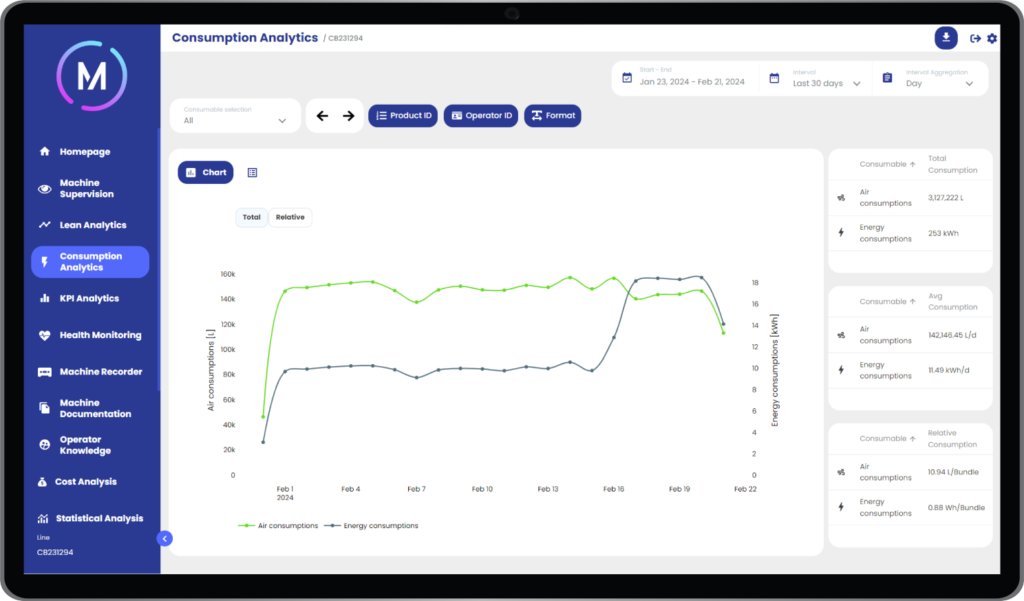

Equipped with a standard module dedicated to consumption analysis (Consumption Analytics), MAT not only constantly monitors utilities, but analyzes them over time, correlates them to the actual production of the machine and allows a series of aggregations and comparisons, For example, analyze the energy consumption for each item produced in the last year.

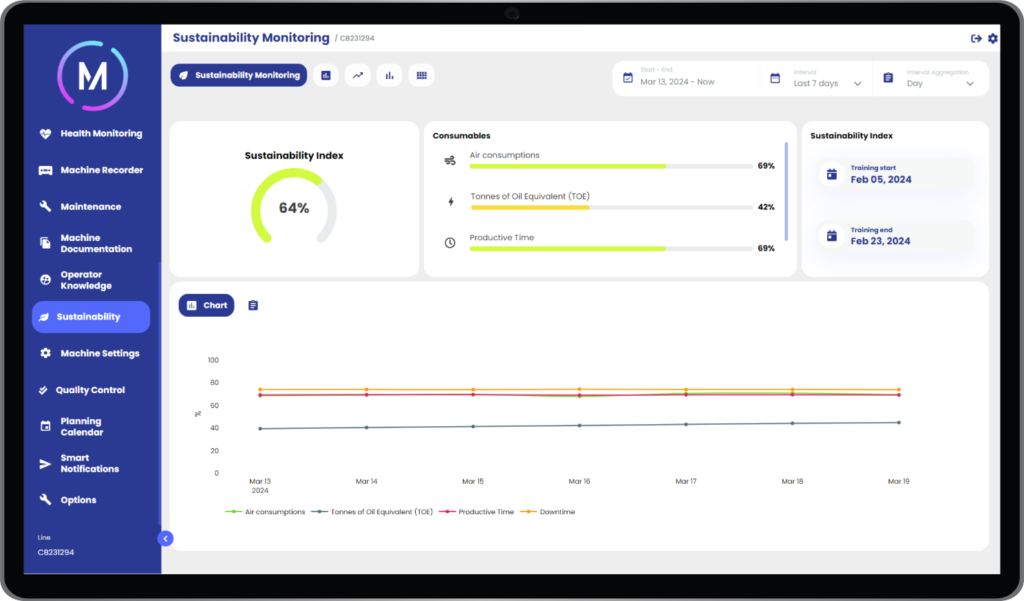

To meet current needs, an advanced module package (Sustainability) has been implemented, which goes beyond simple consumption monitoring. These modules allow you to identify the factors of production that adversely or positively affect energy consumption and keep production costs under control. Moreover, through an artificial intelligence algorithm, it is possible to calculate the Sustainability Index (SI), that is a footprint of the sustainability impact of the machine. The system constantly compares this indicator with real-time data, reporting any deviations and the causes that generated them.

For those who did not attend the webinar organized with Ransomtax – Your Business Partner:

Links to the slides used during the webinar, HERE.